reverse tax calculator uk

Amount without sales tax GST rate GST amount. Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022 to 5 April 2023.

Free Mortgage Calculator Mn The Ultimate Selection Home Equity Loan Calculator Mortgage Amortization Calculator Home Equity Loan

This calculator works on the current United Kingdom VAT rate of 20.

. Amount without sales tax QST rate QST amount. It uniquely allows you to specify any combination of inputs when trying to figure out what your gross income needs to be for the desired net income. Transfer unused allowance to your spouse.

Literally any combination of options works try it - from swapping to. For example 120 is the figure 12 100 which is now the pricefigure excluding VAT. Amount without sales tax GST rate GST amount.

We have just released our Reverse Tax Calculator which calculate net after tax earnings to gross before tax earnings. That means if you have a figure inclusive of VAT Value Added Tax and want to do a vat calculation to remove the 20 VAT then use this reverse VAT calculator. See where that hard-earned money goes - with UK income tax National Insurance student loan and pension deductions.

Reversing Removing VAT Formula. This is based on Income Tax National Insurance. 10000 20000 30000 40000 50000 60000 70000.

Français Home page calculator and conversion. For the second option enter the Sales Tax percentage and the Gross Price of the item which is a monetary value. 2000 2500 or 10000.

Divide the pricefigure by 1. Your customer is registered for VAT in the UK. This alongside other taxes is collected by the government and redistributed in order to fund various public services.

To use the sales tax calculator follow these steps. Any National Insurance costs are taken as a percentage provided that your salary is above 190 each week or 9880 per year from 6 July 2022 to 5 April 2023. VAT stands for value-added tax.

For the first option enter the Sales Tax percentage and the Net Price of the item which is a monetary value. Rerverse calculator of the VAT in UK 20 5 or 0 free reverse calculator of VAT in United Kingdom in 2022. Want to know.

The Salary Calculator has been updated with the latest tax rates which take effect from April 2022. Add or Reverse VAT Calculator. 11 income tax and related need-to-knows.

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel. Reverse Tax Calculator 2022-2023. When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator.

This calculation is used on a regular basis by Personal Injury and Family Law lawyers. See how tax is deducted from your annual salary using this interactive visual income tax breakdown. Reverse Value Added tax calculator UK 2019.

This tells you your take-home pay if you do not have. Income Tax Calculator is the only UK tax calculator that is EASY to use FREE. Up to 2000yr free per child to help with childcare costs.

It is levied on nearly all goods and services provided by UK registered businesses. As of the 4th of January 2011 the default VAT rate stands at 20. UK 2022 2023.

If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by. Reduce tax if you wearwore a uniform. Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

Reverse Value Added tax calculator UK 2020. Most states and local governments collect sales tax on items that. Free tax code calculator.

The Tax Calculator uses tax information from the tax year 2022 2023 to show you take-home pay. More information about the calculations performed is available on the about page. Check your tax code - you may be owed 1000s.

242 per week or 12570 per year. The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

We can assist with uniform expense claims mileage claims Self-Assessment tax returns freelance and sole trader tax returns CIS Tax refunds Oil Gas Industry tax refunds seafarer. This valuable tool has been updated for with latest figures and rules for working out taxes. Any National Insurance costs are taken as a percentage provided that your salary is above 190 each week or 9880 per year from 6 July 2022 to 5 April 2023.

This calculator is useful if you want to calculate VAT backwards. If you are managing online shop you will often have to enter your prices excluding VAT in the admin area of your website. Reverse UK VAT Calculator How to calculate UK VAT Backwards Forwards or in Reverse.

National Insurance Contributions will be taken from your overall income though unless you have already reached the state pension age. Income Tax Calculator is the only UK tax calculator that is EASY to use FREE. On the front end of your website you may want this to be clean price or a rounded price for your customers to view eg.

To use the net to gross calculator you will be required to provide the following information. Here is how the total is calculated before sales tax. Try out the take-home calculator choose the 202223 tax year and see how it affects your take-home pay.

Reverse Tax Calculator - Net To Gross. This is your total annual salary before any. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases.

Payment for the supply is reported within the Construction Industry Scheme. Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. For example the UK VAT rate is 20 which means you would do pricefigure 12.

It responds instantly to changes made to gross income and other inputs so just move the gross income slider to see how income tax national insurance bands work alongside pensions and student loan deductions. There are two options for you to input when using this online calculator. Value Added tax calculator UK 2019.

The reverse charge will need to be used when. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. You also have the option to get the figures for Annual monthly weekly and.

The net to gross salary calculator requests the net pay required and then computes the gross pay computing pay as you earn tax PAYE and National insurance contributions. You can use tax rates from 2013 to 2002 and specify either weekly or annual net after Tax earnings. Calculate your salary take home pay net wage after tax PAYE.

Contact the team at taxbackcouk to get help with filing your UK tax refund claim and find out how much you could be due back from HMRC.

Pro Rata Salary Calculator Uk Tax Calculators

Filing Itr With All India Income Tax Return Income Tax Tax Refund

Tax Benefits For Reverse Mortgage Target Mortgage Lenders Fha Loans Mortgage Brokers

Is This The World S Most Sustainable Building Energy Management Improve Energy Efficiency Industrial Strategy

Uktaxcalculators World Tax Calculator Uk Tax Calculators

Your Four Step Financial Planning Moneymindz Com Visit Https Www Moneymindz Com Give Missed Call Personal Financial Planner Financial Planning Debt Plan

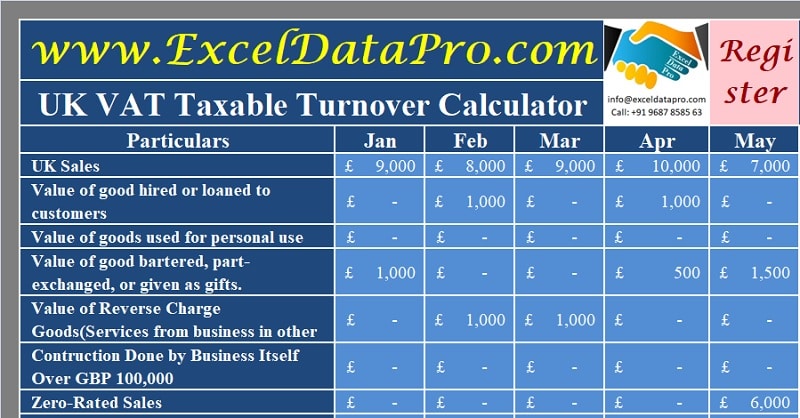

Download Uk Vat Taxable Turnover Calculator Excel Template Exceldatapro

Vat Calculator Online 2022 With The Updated Vat Rates

Pin By Marina Seganti On Passiocase Reverse Image Search Online Presence Image Search Engine

The Hp 15c Calculator Scientific Calculator Was An Rpn Reverse Polish Notation Calculator That Was Popular Wi Scientific Calculator Old Calculator Calculator